Nigeria, like other Low-and-Middle-Income Countries (LMICs), is recording an increasing burden of Non-Communicable Diseases (NCDs), as close to a third of all deaths in the country is now attributable to NCDs. It is imperative to deploy effective tools to tackle NCDs including health taxes by exploring the political and socio-economic factorsthat influence their design and implementation.

As part of the evidence-based approach to understanding the political and socio-economic factors that influence the design and implementation of health tax policies in Nigeria, DGI Consult with funding from the WHO Alliance for Health Policy and Systems Research (AHPSR) in collaboration with the Federal Ministry of Health (FMoH) organized a multi-stakeholders policy dialogue to present the preliminary findings of the health taxes policy analysis conducted by DGI Consult and elicit additional input and insights from stakeholders, which is a multinational research programme aimed at providing health policy analysis for health taxes in low- and middle-income countries.

The 1-day hybrid policy dialogue themed “Forging Consensus Towards Accelerated Health Tax Policy Design and Implementation” held on Tuesday 14th of May, 2024 featured diverse stakeholders at the federal level. These include representatives from the FMoH, National Assembly Senate Committee on Health, Nigeria UHC Forum, Health Sector Reform Coalition (HSRC), Nigeria Action for Sugar Reduction (NASR); Nigerian Tobacco Control Alliance (NTCA), Private Sector Health Alliance of Nigeria, Federal Inland Revenue Service (FIRS), donors and implementing partners, amongst others.

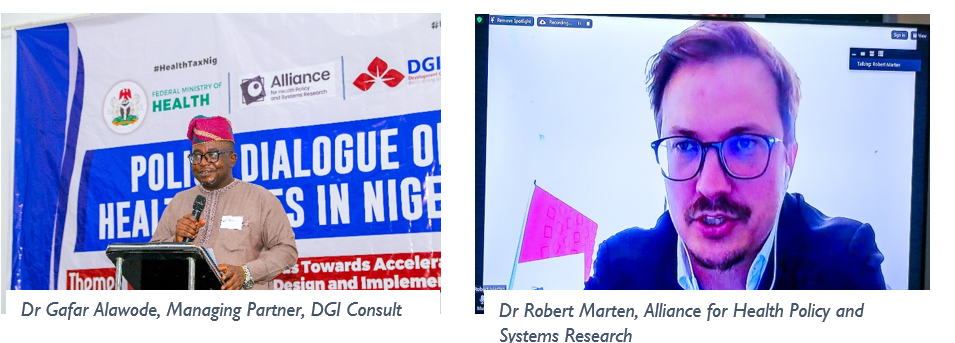

In his welcome address, Dr Gafar Alawode, the Managing Partner of DGI Consult and the Principal Investigator of Health Taxes Policy Analysis, highlighted the importance of forging a robust and well-informed coalition across sectors to bolster the implementation of potent health tax policy in Nigeria. He also emphasized the importance of tackling misleading industry-driven narratives aimed at weakening health tax implementation. He further advocated for the need to have a dynamic database to track consumption trends and gauge the efficacy of tax rates, facilitating necessary policy adjustments.

Dr. Robert Marten from the Alliance for Health Policy and Systems Research stressed the imperative of understanding the global political economy surrounding health taxes. He called for a concerted study aimed at enriching the design, adoption, and implementation of such taxes by delving into their political dynamics.

An overview the preliminary findings of the health policy analysis for health taxes in Nigeria, which include the methodology, findings, and key recommendations for improving health tax policy design and implementation, was presented by the research team of DGI Consult to set the stage for additional insights and recommendations from stakeholders.

The panel session of the dialogue further elicits information on effective strategies for health tax policy design and implementation in Nigeria while aligning with the global standard. The panel session featured diverse industry and system experts which include Danielle Bloom (WHO Global Tax Program); Dr Yakubu J.S (Department of Food and Drugs Services, FMoH); Mr. Mathew Osanekwu (Tax Policy and Advisory Department, FIRS), Prof. Chima Onoka (Special Technical Adviser to Chairman, Senate Committee on Health), Dr Bolanle Olusola-Faleye (Chief of Party USAID Local Health System Sustainability Project), and Dr Chibuike Nwokoye (Project Manager, Nigerian Tobacco Control Alliance). The panel discussion also identified a narrative-changing course of action for the effective design & implementation of existing policies for health taxes through the roles of different actors and institutions.

DGI Consult will incorporate the key insights and recommendations from the policy dialogue into the report on the health policy analysis for health taxes, which will inform the context-appropriate design and implementation of health tax policies in Nigeria.

Comments are closed.